Read Our Brochure

Click here (PDF)

EIN: 83-0721126

“I do not object to taxation of income, and I would not object to paying my fair share of taxes for positive, life-enhancing government programs, but I will not pay someone to kill in my name or to make weapons whose sole purpose is to threaten life. … We must practice being moral in order to become moral.” – LB

“But even though [my tax refusal is] merely symbolic, it’s something, some very little thing, in an effort to stand with those … in Iraq, and those in the United States, who have gone without health care, decent schools, roads, lived in poverty so that we might spread the American empire across the globe.” MP

“I cannot in conscience pay for war and killing, weapons and bombs, destruction of families and communities–these our federal taxes perpetuate. I have tried by the work I choose and the life style I have chosen, to, in a small way, create another reality in which violence and threat of violence are unimaginable and unuseful.” JS

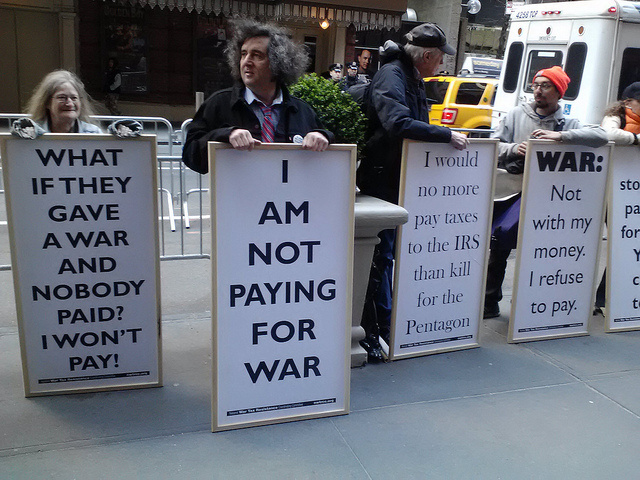

War-tax resisters protest in New York City in April, 2013. Photo via Flickr user The All-Nite Images

Statement of Purpose

The War Tax Resisters Penalty Fund provides a vehicle through which people can directly assist war tax resisters whose taxes are collected by the IRS and for whom the collection of penalties and interest is a burden. In providing this mutual support, the Penalty Fund hopes to sustain and expand war tax resistance as a form of conscientious objection to war.

History of the Fund

The War Tax Resisters Penalty Fund began more than 30 years ago Read More

How the Penalty Fund works

To join the list: send your contact information to Peter Smith at webmaster@nwtrcc.org or fill in the registration form.

To request assistance: send documents to WTRPF, 1036 N. Niles Ave, South Bend, IN 46617 (see How the Penalty Fund Works link for details).

To contribute to an appeal for funds: write a check to War Tax Resistance Penalty Fund and send it to:

WTRPF c/o Peter Smith

1036 N. Niles Ave

South Bend, IN 46617

Note that donations to WTRPF are not tax deductible.

To pay by credit card, click the following button

Who administers the fund?

A steering committee made up of people from NWTRCC operate the fund. We welcome others who would like to serve on the steering committee. Contact us if you would like to serve.

Shulamith Eagle (Pennsylvania), Steve Leeds (California), Bill Ramsey (Massachusetts), Peter Smith (Indiana), and Shirley Whiteside (Iowa)

Why we do it

If money could buy security, we’d be the most secure country in the world.Read More

Older appeals:

Summer 2023 update letter (PDF)

June 2022 update letter (PDF)

Summer 2021 update letter (PDF)

April 2020 update letter (PDF)

September 2019 appeal letter (PDF)

Summer 2018 update letter (PDF)

Spring 2018 appeal letter (PDF)

Winter 2017 update letter (PDF)

Winter 2016 appeal letter (PDF)

Spring 2016 update letter (PDF)

Winter 2015 appeal letter (PDF)

Summer 2015 appeal letter (PDF)

Peter Smith Northern Spirit Radio interview

January, 2014, letter to NWTRCC members reactivating the Penalty Fund

Link to the National War Tax Resistance Coordinating Committee website