Controlling Federal Income Tax Withholding

This publication is one of a series of “practicals” that offer ideas, tips, and information for individuals who want to cut off their financial support for the U.S. war machine or are currently practicing war tax resistance. The full list of the “Practical Series” appears at the end of the text along with other relevant resources.

Many people feel they should resist militarism by resisting the payment of federal income taxes. Yet they believe they are unable to engage in war tax resistance because taxes are withheld from their salary or wages. Almost everyone can overcome this obstacle. Thousands of war tax resisters have stopped the withholding of income taxes that would be used for military spending by claiming additional deductions or exemption from withholding on their W-4 forms. This publication explains how people reduce or eliminate withholding and some of the possible consequences. It does not apply to Social Security or FICA taxes. State tax withholding can be set at a different rate as desired.

W-4 Deductions

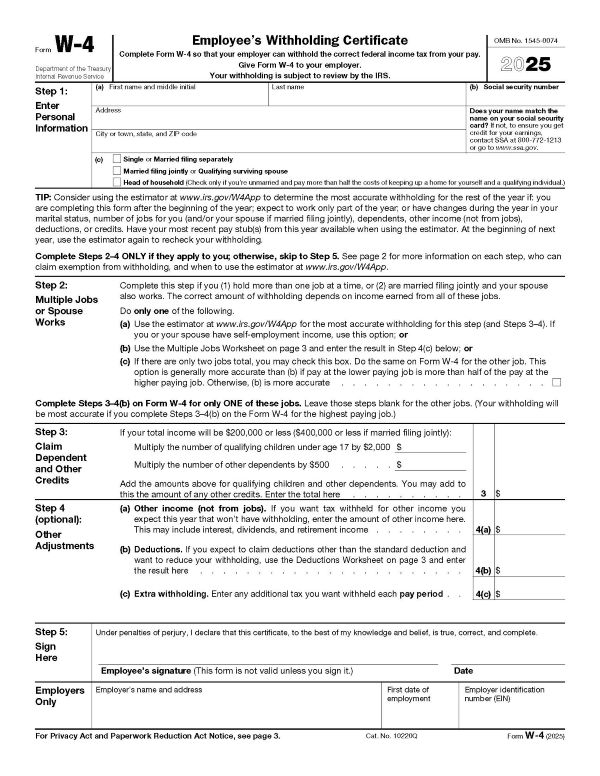

Form W-4, the Employee’s Withholding Certificate, (irs.gov/pub/irs-pdf/fw4.pdf) is an IRS form that most employees must fill out when they begin a job. The employer uses it to deter-mine the amount of federal income tax to be subtracted from an employee’s wages or salary. Anyone may fill out a new W-4 at any time, and is advised to do so whenever her or his personal or financial status changes.

This publication addresses the updated W-4 form that the IRS released in January 2020. Previously, the W-4 form determined one’s federal withholding by using “withholding allowances,” which allowed people to claim allowances for themselves, for their dependents, and for deductions and credits they expected to claim on their tax returns, such as medical bills, mortgage interest, student loan interest, charitable gifts, child care costs, retirement contributions, and many other deductible payments. The updated form is much simpler. People now claim deductions that closely correspond to the deductions and tax credits taken on one’s tax return.

Employees are responsible for the number of deductions they claim on their W-4 forms. Employees are not required by law or etiquette to explain their deductions to employers. In fact, an employer could not know how many deductions an employee is legally entitled to claim without being fully informed about that person’s private financial situation.

To prevent or reduce the withholding of income taxes for war tax resistance purposes, an individual first figures out all the deductions and credits to which she or he is legally entitled according to IRS regulations. This process is explained on the W-4 form worksheet. The tax resister then claims additional deductions to stop the withholding at the level they have chosen to resist or protest war taxes. Whether it is 10%, 50%, 100% refused is a matter of personal, political, and ethical choice.

The IRS instructions on the W-4 form are so complicated that many people are not prepared to contend with them in the atmosphere of a personnel office or job site where the form is usually filled out. It is a good idea to study the form in advance and figure out how many deductions IRS rules permit and how many extra deductions to claim for war tax resistance purposes. You can also take the form home to fill out and return it the next day. The law requires only that the W-4 form itself (page 1) be filed. It is not necessary to return the worksheet (page 3) to the employer.

Calculating Deductions

One way to decide how many deductions to take is to consult IRS Publication 15-T, Income Tax Federal Withholding Methods (www.irs.gov/pub/irs-pdf/p15t.pdf), to determine the total number of legal deductions and the number needed to reduce or prevent withholding. The booklet is available on the IRS website, or your employer may have a copy. Use the “Wage Bracket” charts to find your filing category (single, paid weekly; married, paid monthly; etc.) and salary level. From the chart you can choose the number of deductions to take to have partial to zero withholding.

Note that unless your state has its own W-4 form, any increase in deductions on the W-4 to reduce federal income tax withholding will also reduce state/local income withholding. Virtually all employers have software or the ability to have different allowances for federal and state/local taxes. If your state does not have its own W-4 form, attach a note on your W-4 or talk with the payroll person about using a different allowance or deduction number for state taxes as desired. Some WTRs choose to refuse state taxes but the information in this booklet and from NWTRCC focuses on federal taxes.

Example: How to Resist Withholding for a Single

Person Without Children (2025)

| Single Person with annual wages of: | $40,000 |

| Standard Deduction | $15,750 |

| Annual Wages less Standard Deduction: $40,000 – $15,750 = | $24,250 |

| To Have $0 Withholding, Place $24,250 on Deductions Line 4b | $24,250 |

| Annual Taxable Wages less Deductions: $24,250 – $24,250 = | $0 |

In other words, taking a $24,250 deduction on deductions line 4(b) will indicate to your employer that you have no taxable income and bring with-holding to zero. To resist 50%, divide $24,250 by 2, which equals $12,125. And place $12,125 on deductions line 4(b).

|

You can also use the formula method (see sample above). Under the 2025 withholding tables and rates, the first $15,750 of a single person’s, $23,650 of a head of household’s, or $31,500 of a married person’s jointly filed annual income is exempt from withholding. Above these amounts, each qualifying child under seventeen claimed on the W-4 exempts another $2,000 of one’s annual income from withholding. And each qualifying dependent not under seventeen claimed on the W-4 exempts another $500 of one’s annual income from withholding. The new W-4 form, if filled out accurately, is supposed to eliminate both refunds and taxes due. Those people who fill out their W-4 to receive a refund are providing the government an interest-free loan during the year to pay for wars. At this point, a resister can choose to take additional deductions to lower their federal tax withholding. This method allows you to make choices about resistance.

Exemption from Withholding

The “Exempt” option on the W-4 form is intended for use by people who owed no taxes the previous year and expect to owe none in the current year. Claiming exempt will prevent income taxes from being withheld from a person’s wages or salary. People who work only part of a year, or who have widely fluctuating wages, may have to claim a higher number of deductions or claim exempt in order to prevent over-withholding. (See IRS Publication 505-Tax Withholding and Estimated Tax www.irs.gov/pub/irs-pdf/p505.pdf). Generally, individuals should choose to file exempt only if they meet the criteria noted on the W-4 form. The IRS may easily be able to prove that money was owed “the previous year,” thus opening up the possibility of a charge for perjury for filing a “false or fraudulent” W-4 form. To file an “Exempt” W-4 form, write “Exempt” on Form W-4 in the space below box 4(c)—there is no special box to write exempt as with the old form.

IRS and Employers’ Power to Reject a W-4

Although we are personally responsible for the claims we make on our W-4 forms, employers have a limited authority to reject a W-4.Under the regulations, employers are supposed to reject a W-4 and request a corrected one if a per-son has altered or added on to any of the printed language on the W-4. With the pre-2020 form, a W-4 could be rejected if a person verbally communicated that they were claiming allowances not permitted by IRS rules. So if a person told an employer that they are claiming extra allowances because of war tax resistance, the employer was supposed to reject the W-4. The current IRS info form to employers has removed this second reason for rejecting a W-4 form, but it is often advisable that a person not justify her or his war tax resistance deduction claims to an employer

W-4 Form for 2025

War tax resisters should be aware that the IRS uses information reported on W-2 statements sent to the IRS at the end of each year by employers and matched with taxpayer returns to locate problem W-4s. If the IRS sends a written notice to an employer asking to see an employee’s W-4, the employer is required to submit it to the IRS.

When the IRS suspects there is a serious under-withholding problem, they may notify the employer with a “lock-in” letter to withhold income tax from that employee at a higher rate and with the minimum number of permissible deductions stated. If a lock-in letter is received, the employee will be given a date by which to appeal or verify their deductions to the IRS. If the claim is not defended to the satisfaction of the IRS, the employ-er must withhold according to the IRS’s lock-in letter or face penalties. At this point an employee cannot submit a new W-4 to their employer, but must send it to the IRS for approval. An employer cannot decrease withholding for that individual unless notified by the IRS. If the employee has left the job when a lock-in letter is received, no action by the employer is required. The lock-in letter stands for 12 months, so if the individual re-turns to the job within 12 months the employer must withhold according to the lock-in letter.

However, unless you are under scrutiny by the IRS or have received a lock-in letter, changes to W-4s are allowed anytime. If you have had more tax withheld during the year than you wished, you may adjust your deductions upwards (for less with-holding) by giving your employer a new W-4. The employer must withhold according to your new W-4 no later than the first pay period 30 days following its receipt.

If you file electronically or allow a tax preparer to do so for you, the system may automatically calculate a penalty for an insufficient amount of tax paid through withholding. Take control and make your own choice about penalties by filing a paper return or asking your tax preparer to use the paper return.

Legal Consequences of W-4 Resistance

The IRS may assess a $500 civil penalty for a false W-4 if they decide excessive deductions have been claimed. If the $500 false W-4 penalty is wrongly imposed, this can be challenged by seeking an “abatement” of the penalty through the “W-4 Coordinator” at the IRS Service Center. A W-4 claiming excessive deductions is not subject to the civil penalty for filing a “frivolous tax return.”

There is also a criminal penalty of up to one year in jail and/or a fine of up to $100,000 for “willfully supplying false or fraudulent information” on a W-4 form to decrease the amount of withholding. Criminal penalties cannot be applied automatically. Only 16 war tax resisters have been criminally prosecuted for W-4 resistance since WWII; six of them served jail sentences ranging from 30 days to nine months. Only one war tax resister has been prosecuted since 1973, so the current risk of criminal prosecution appears to be small. However, IRS pol-icy and procedure on criminal prosecution could change in the future and resisters should be aware of such a possibility.

Currently, the IRS relies on tightened rules and monitoring W-2 forms (end-year reporting) against W-4 claims as the main enforcement tools. Despite requests for notification to war tax resistance counselors, there is little data to show how often the IRS sends a lock-in letter or orders employers to withhold at the highest possible rate from the paychecks of war tax resisters. Likewise, there is no indication that the $500 civil penalty has been levied on a war tax resister in recent years.

If a lock-in letter is received by your employer, unless you work for a very sympathetic business or organization (See Practical #6, Organizational War Tax Resistance), your options are quite limited. Arguing for added deductions must be based on deductions according to IRS determination. Lowering your salary would decrease the amount of taxes withheld. Quitting the job resolves the situation, but may not be practical for every resister. The lock-in letter is held by the employer for 12 months and would become active if you return to the same job in that time.

Dealing with Employers

Employees are not required by law to explain their deductions to employers. Many people are very anxious about how a new employer will react if they claim significant deductions, or how an old employer will react if they increase the number of deductions they claim. Experience has shown that a firm, polite attitude in response to an employer’s questions helps assert personal responsibility for one’s claim and satisfies the employer. Such replies as, “This is the number of deductions I believe I am entitled to,” “This is my personal tax situation,” or “This is the deduction I have been advised to claim,” may satisfy an employer. If an employer balks or persists in asking for further explanation, a simple repetition of the same or slightly varied responses usually gets the message across that this is a personal, private matter and that no further explanation will be offered.

The Issue of Truthfulness

Some people, concerned about truthfulness in their relation-ships, are troubled about signing the declaration at the bot-tom of the W-4 after claiming extra deductions, because it might be interpreted as a false statement. Some, however, have come to understand these claims as honest. They make these claims because they firmly believe it is wrong to pay taxes for war, and that they are morally entitled to refuse to pay them. When they sign the certification on the W-4, they feel they are making an honest statement of belief, even though they realize the IRS would disagree

April 15 — To File or Not to File

Many war tax resisters file returns; others do not. The decision whether to file a return is a personal one. See Practical WTR #2: To File or Not To File an Income Tax Return for more information. Here are a few factors regarding W-4 forms.

Showing a significant amount of taxes due on a 1040 filed with the IRS may trigger a request by the IRS to see the cor-responding W-4. Salaried war tax resisters who file returns might be more likely to have their employers instructed to reject their W-4 forms with the added possibility of being assessed the $500 civil penalty for a false W-4 (the latter is rare).

On the other hand, a number of war tax resisters in salaried jobs accept withholding but make the choice not to file a re-turn with the IRS. It is advisable to fill out a tax form each year in part to make sure there is no refund due. If the desire is to refuse to cooperate with war taxation, leaving a refund in the federal coffers guarantees that some of that money will go to war. Calculate your taxes with any credits and deductions to be sure that you do not end up giving the government money you intended to resist.

Summary

This publication explains the methods used by salaried employees to control withholding so that they are in a position to refuse to pay for war. Too often war tax resistance counselors hear salaried employees say, “I can’t resist; the money is taken out of my paycheck automatically.” However, unlike in other countries, the employee in the United States submits the information to their employer that sets the rate at which taxes are taken out of (withheld from) their paycheck.

In the U.S., we have the opportunity to resist. This can involve an act of civil disobedience with some risks and potential penalties. With taxes due at the end of year, the individual can still choose how much to pay or not pay, depending on their motivations and goals for their war tax refusal.

Reading through this publication and talking with a war tax resistance counselor helps those who want to refuse to pay for war to make an informed decision. We encourage all war tax resisters to talk with friends, family, and the general public about why we make these choices. We also encourage people to devote their resisted taxes to works of peace, education, social sharing, and the common good.

Resources

- Form W-4, the Employee’s Withholding Allowance Certificate, [http://www.irs.gov/pub/irs-pdf/fw4.pdf]

- Publication 15, The Employers Tax Guide (Circular E) [http://www.irs.gov/pub/irs-pdf/p15.pdf]

- Publication 15-A, The Employers Supplemental Tax Guide [http://www.irs.gov/pub/irs-pdf/p15a.pdf]

- Publication 15-T, Federal Income Tax Withholding Methods [http://www.irs.gov/pub/irs-pdf/p15a.pdf]

- Publication 505 — Tax Withholding and Estimated Tax [http://www.irs.gov/pub/irs-pdf/p505.pdf]

- Stand Up to the IRS, by Frederick W. Daily, 13th Edition, 2017, Nolo Press, 950 Parker Street, Berkeley, CA 94710-9867, www.nolo.com.

Available from NWTRCC:

-

- W-4 Resistance web page with links and “How-to” video

Practical War Tax Resistance Series:

-

-

- Practical #1: Controlling Federal Tax Withholding

- Practical #2: To File or Not To File an Income Tax Return

- Practical #3: How to Resist Collection , or Make the Most of Collection When it Occurs

- Practical #5: Low Income/Simple Living as War Tax Resistance

- Practical #6: Organizational War Tax Resistance

- Practical #7: Health Care and Income Security and War Tax Resistance

- Practical #8: Relationships and War Tax Resistance

-

(Single copies #1–3, #1.00 each; #4–8, $1.50 each; 20% discount for NWTRCC affiliates)

These practical booklets can also be found at nwtrcc.org. Go to the Recsources tab and click on Pamphlets.

NWTRCC is a coalition of local, regional, and national groups supportive of war tax resistance.

Updated 9/2025